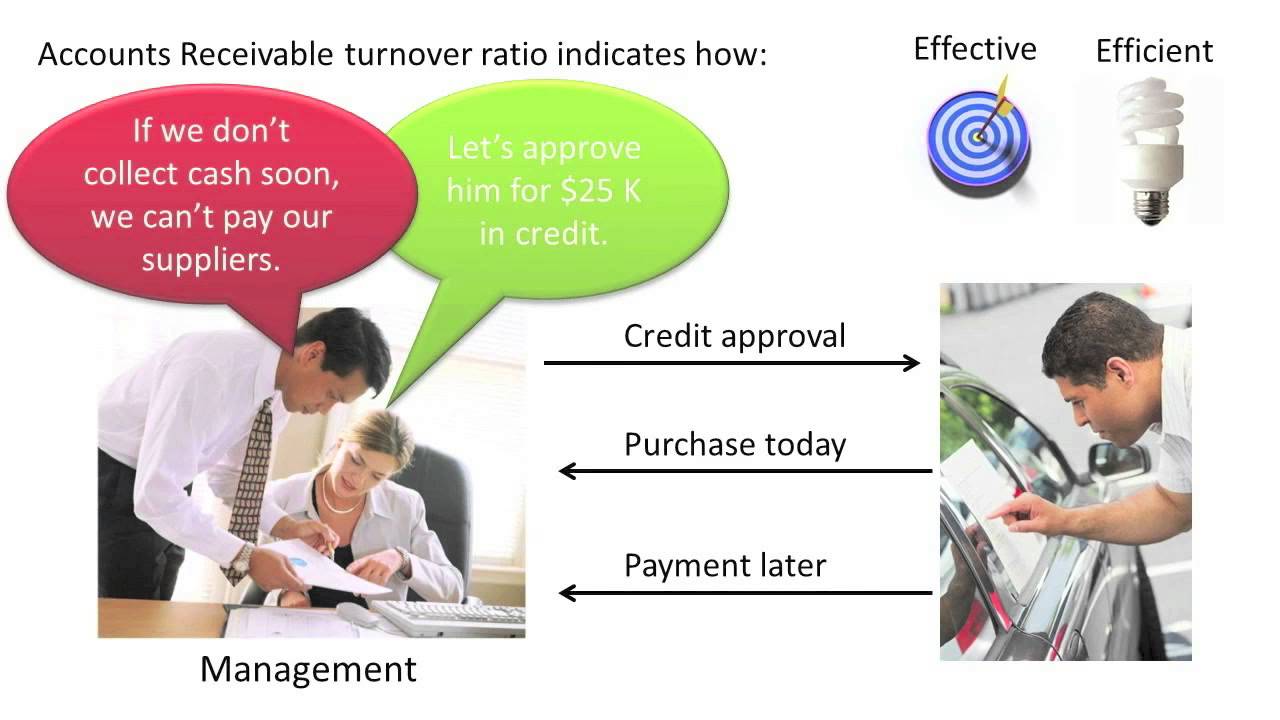

Typically, companies establish payment terms according to 30-, 60- or 90-day periods. Businesses that collect from accounts receivables extend credit to their customers according to specific payment terms. Using the accounts receivable turnover ratio is effective because it tracks the average rate customers make payments for credit purchases. Related: What Is Accounts Receivable Turnover? Why use the receivables turnover ratio? Dividing these two values gives you the receivables turnover ratio. The average receivables value is the average amount the receivables account collects in the same period. In the formula, the net credit sales value represents the total amount of credit sales your company makes over a specific period. (Receivables turnover ratio = Net sales on credit / Average receivables) To find receivables turnover, apply the formula: This accounting metric is also an important indicator of how effectively companies manage customer credit accounts, as the ratio provides insight into whether companies extend too much credit. If your company lets customers make large purchases on credit, the receivables turnover ratio is an effective metric for evaluating how quickly the company collects on extended credit and short-term payments. The accounts receivables turnover ratio measures a business's ability to collect on payments its customers owe for products or services.

Account receivable turnover how to#

In this article, we explore what the receivables turnover ratio is, why it's an effective metric to use and how to calculate it, with examples to help you apply the formulas. This ratio measures the average rate at which companies collect payments due from clients and can tell you about profitability. While it's beneficial to allow customers to purchase products and services on credit, it can affect the receivables turnover ratio. When companies extend credit to customers, they collect payments from accounts receivable.

Account receivable turnover professional#

To achieve a healthy receivable turnover ratio, many savvy finance and credit professionals leverage the use of professional outsource receivable management services rather than attempting to maintain in-house accounts receivable staff with the associated costs and human resource headaches.Ĭontact us today or schedule a free consultation on how AAB can boost your accounts receivable turnover.Receivables turnover ratio = (Net sales on credit / Average receivables)

Boost your Accounts Receivable Turnover Ratio Newco's account receivable turnover for the quarter was:ġ6,390,450 / (3,468,199 + 3,549,026) / 2 which equates to 4.7 times - annualize would be multiple by 4 = 18.7 times. Sales for its fiscal fourth quarter ended Septemwere $16,390,450,000 and Accounts receivable, net for Jand Sept. Now a quarterly look at Newco's accounts receivable turnover: NEWCO CORPORATION sales for its fiscal year ended Septemwere $66,074,312,000 and Accounts receivable, net for the years ended Sept. The formula for accounts receivable turnover :Īccount receivable turnover = total credit sales / average accounts receivable balance Accounts Receivable Turnover Example The accounts receivable turnover ratio is also known as the sales-to-receivable ratio. Also, if calculating the account receivable turnover ratio on any time period other than an annual or year-to-year basis, you need to account for the period. In that case, the calculation will not be true and can be very misleading.

Suppose all sales are included and there is a measurable amount of cash sales. It should be noted that only credit sales are used in the receivable turnover calculation. Accounts Receivable Turnover Ratio Formula One of the most important statistics for a credit department is the accounts receivable turnover ratio. A higher turnover ratio will assist you in negotiating to finance for your business or getting the best possible price, should you decide to sell. Generally, the higher the receivable turnover ratio, the higher the value a lending institution will place on your accounts receivable. Trucking and Transportation CollectionsĪccounts receivable turnover ratio or receivable turnover ratio measures the liquidity of a company's accounts receivable.Small Business Debt Collection and Cash Flow.A Collection Agency Collecting Commercial Debt in the US.

0 kommentar(er)

0 kommentar(er)